Intro

Discover the AI Impact on Society in 2025. LoppZ guides you through key changes, opportunities, and ethical challenges. Read more!

In preparing for retirement, you may have heard of 401k accounts, Health savings accounts or HSAs, and individual retirement accounts or IRAs. Each can play a crucial role in helping you plan for retirement.

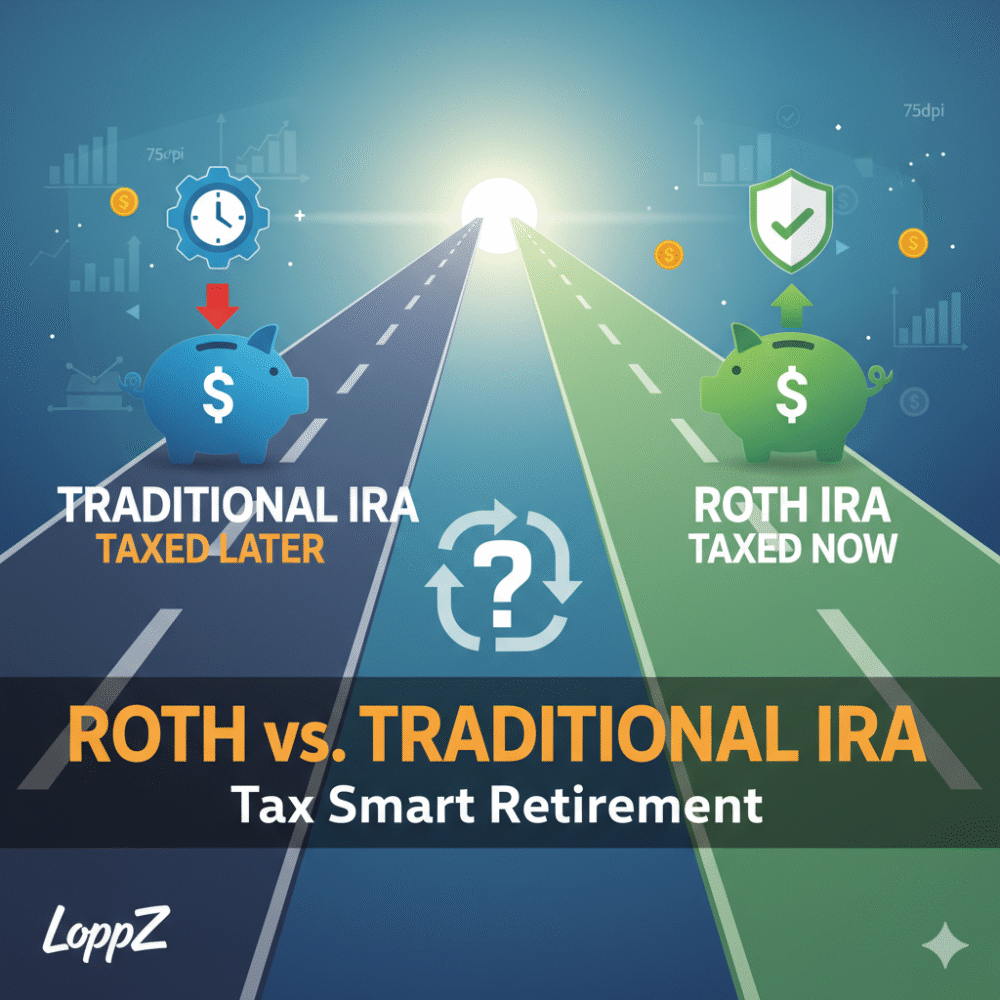

In this post, let’s focus on the IRA accounts and the differences and advantages between them. There are two main types of IRAs, the Traditional and the Roth.

The Traditional IRA allows you to contribute money that has not yet been taxed. This is considered pre-tax income. Once in the account, your money can grow tax-deferred, but you’ll have to pay income taxes once you begin to withdraw funds later.

Tax Differences: Major Difference between Roth IRA and Traditional IRA

The basic difference between the two accounts is on when you’ll be taxed.

Your choice to make tax payment up-front or at withdrawal depends on one big idea. Will your income tax bracket be lower in the future? Your answer to this will be a big determinant of if you use a traditional or Roth account.

Early Withdrawals

The magic age for withdrawals without penalties for all retirement accounts is 59 ½. But life hits us all differently, and sometimes you’ll need access to money in your retirement accounts.

Though we typically strongly suggest not pulling money out of any retirement account, until actually retired, one big advantage of the Roth IRA over its counterpart is flexible early withdrawals.

Since you contribute to Roth IRA with funds you’ve already paid taxes on, you can withdraw your contributions (but not any gains) free without penalties as long as it’s been in the account over 5 years.

Be careful though because you will incur penalties if you try and withdraw the gains or earnings that your money accumulated.

With the Traditional IRA, you can only withdraw without penalty after you turn 59 ½. Though you can make early withdrawals, you’ll be hit with income taxes, and most times, you’ll have to pay a 10% early withdrawal penalty to the IRS.

Lastly, Roth IRAs have an additional potential advantage over traditional IRAs. Since you can pull your contributed amount early from the account, some may utilize their Roth IRA as an emergency fund.

Once again, we typically suggest that you build your emergency fund and put it in a high yield savings account, but life happens, and these funds could be there for you in the event you need some extra cash.

Required Minimum Distributions (RMDs)

Required minimum distributions also known as RMDs are mandatory yearly withdrawals. At the time of this post, the age where this is required to start is 72 years old.

Traditional IRA accounts (and typically all traditional types of retirement accounts) have an RMD requirement, while Roth accounts do not have required minimum distributions. The reasoning for this is simple.

The US government wants to be able to tax you at some point, so it requires you to begin to withdraw at a specific age.

The opportunity to ignore compulsory withdrawal is one very big advantage you’ll enjoy with a Roth IRA.

Income Limits

While anyone can open and contribute to a Traditional IRA, regardless of your annual income, income limits can prevent you from contributing to Roth IRAs.

For you to contribute to a Roth IRA directly as of 2022, you must make less than $144,000, and for married filling jointly, that number is $214,000.

What They Have in Common

We’ve talked about some of the differences between the two, but there are commonalities as well. There are rules and advantages to investing in an IRA, regardless of if you choose the Roth or Traditional route.

Tax Free Growth

Roth and Traditional IRAs both come with tax-free investment growth. Meaning, you’ll have paid the tax before or you’ll pay it later upon withdrawal, but while the money is growing in your account, it is not being taxed.

This allows your money to grow and compound for many years and decades if you allow it. This is awesome because in a normal investment brokerage account, you will have to pay taxes each time you sell an investment and make a gain or each time you receive a dividend.

Allowing your money time to compound without taxation strengthens your path toward wealth and financial freedom.

Contribution Deadlines and Limits

You can contribute money to your retirement account so long as you have taxable income.

This is important. Annual contribution limits are the same for both Roth and Traditional IRAs. As of 2022, this limit is $6,000. If you are 50 years or older, you can contribute an additional $1,000 in “catch up contributions”.

Which is Best for You?

Now that we’ve discussed the two accounts, you may be wondering which option is best for you.

This is because if you expect lower tax rates in retirement, you can choose a traditional IRA that comes with an upfront tax advantage while if you think the rate will be higher in retirement, you can choose a Roth IRA with its delayed tax benefits.Remember that Roth IRA contributions aren’t tax deductible when you withdraw.

But with a moderate-to-high tax bracket now, then traditional IRA tax savings contributions could be the better way for you. So, a traditional IRA has the upfront tax break over the Roth, and it also has no income limit, meaning regardless of how much money you make, you can contribute to this account.

For high income earners, or those looking to reduce their taxable income, it is effectively “cheaper” to save for retirement, as tax savings each year reduce your contribution.

Outro

Both IRAs can be very good options for retirement savings. No matter which one you decide to go with, the sooner you begin to invest and put the compounding interest rate power to work for you, the better off you’ll be in retirement.

Tell us, do you currently contribute to an IRA? Which did you choose? If you learned something new today reading this post, share it with your friends.