Intro

Master effective budget planning 2025 with our step-by-step guide. Achieve financial control & start saving smarter today on LoppZ.

It is necessary to understand your net value to achieve insight into your financial welfare. “How am I doing financially?” And “Is my financial goals being met?” Two of the most asked questions are.

These questions and more can be answered by tracking your net worth. It is one of the most fundamental principles of wealth. Welcome to this post; today it’s all about understanding your net worth! On your financial journey, there are a few items that you’ll continuously need to keep track of, and your net worth is one of them.

This is a broad-level indicator letting you know if you’re heading in the direction you want for your financial goals. So, let’s get things started.

What Is Net Worth?

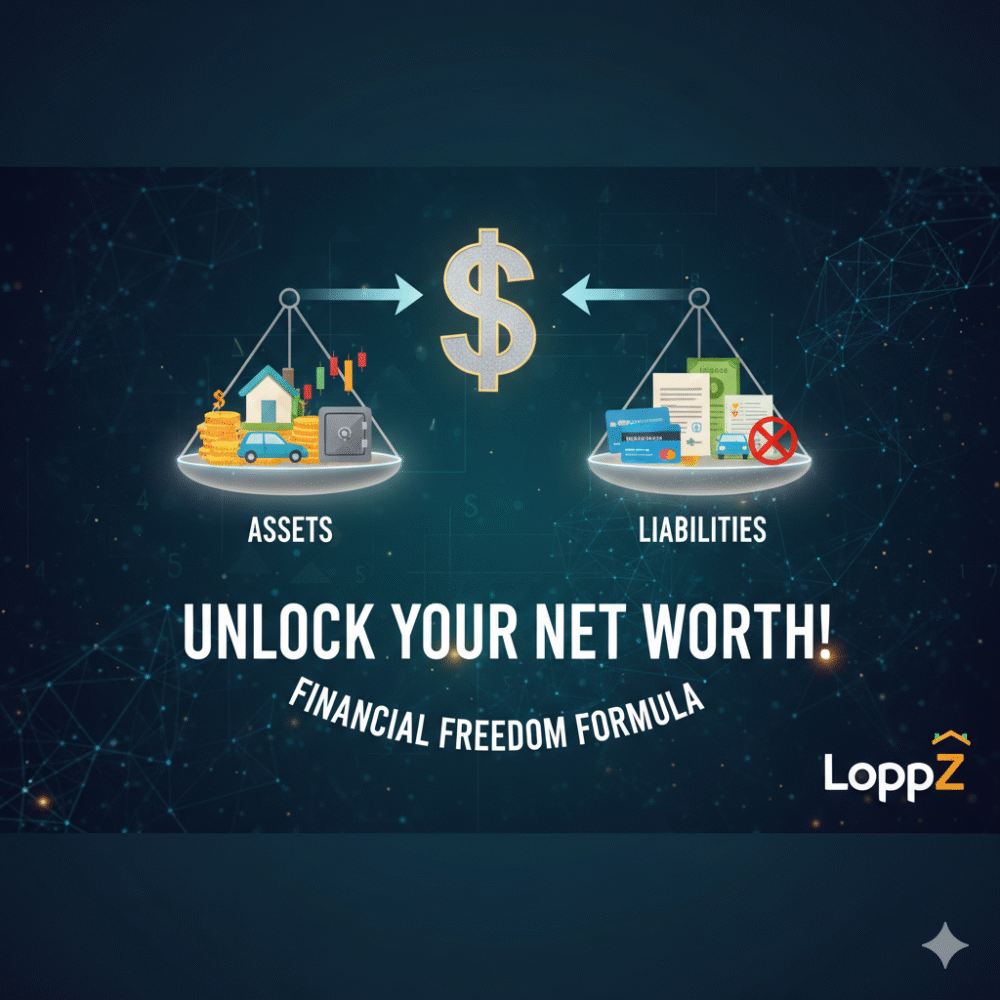

Your net worth is an excellent solution for your financial good because it shows whether your total assets are more than your total debt.

In financial planning, such as buying a house or business or formulating a retirement strategy, someone’s net worth can be an essential indicator. The value of your assets mines the amount given by you on your loans or expenses.

Put another way, your net worth is the amount you have left after paying off all your debts and obligations. A positive net worth indicates that you have more money than you owe, which is a good predictor of your financial well-being.

Assets include retirement accounts, homes, automobiles, jewelry, art and other items of monetary value. Liabilities include all your loans, including mortgage payments, auto loans, credit card loans and student loans.

How To Calculate Net Worth?

How do you calculate your net worth? It’s the difference between the value of your assets and obligations. Simply put: Everything you own, less everything you owe, is summed up in one number that is your net worth.

It’s a clear picture of where you stand financially. Creating a balance sheet is the best technique to determine your net worth. List all of your possessions in one column, along with an estimate of their market value if you had to sell them.

In the second column, write down all your debts. Your net worth is the difference between your assets and liabilities. For many of us, the initial calculation of our net worth can be a negative number, meaning we owe much more than we own.

That’s okay because now we know what to focus on and how to better plan our next steps.

Step 1 – Identify Assets

Calculating your net worth is not as straightforward as it appears, but using this tool to plan your finances is crucial. In our lifetimes, we accumulate a wide range of financial resources. Take a critical look at what you own and where you keep your money to identify all of your assets.

What are your assets that can be sold for cash? This list should include everything you possess that has a monetary value. Estimated values are available to you in some instances.

Accurate estimates of real estate and automobile worth are available through resources like Kelley Blue Book and Zillow. When calculating net worth, it’s best to be conservative when estimating market value where you don’t have one.

You also have investigation, savings, money market and other bank accounts. To get a clear picture of your financial condition, you should add your IRA and 401 (K) Fund and any other investment such as stock, bond, gold or cryptocurrency.

- Also, do not forget to include any business interest or other assets.

Step 2 – Identify Liabilities

As part of a comprehensive financial plan, you must include all of your outstanding loans. Debt that you must pay back in totals, such as personal and school loans, must be recorded as a liability on your financial statements.

You can look at your most recent loan statement to determine how much money you still owe and then use that amount to calculate your net worth.

In other cases, the debt is related to a specific asset, such as a car or house. When calculating your net worth, take into account any outstanding loan balances.

Your home would be worth less than its assessed value if the outstanding mortgage debt were considered when determining its asset value. Your net worth includes the value of the difference between the two estimates.

Credit card debt, money owed to store cards, or any other outstanding obligation should also be included. Don’t forget to consider any business debt secured against your personal assets.

Debt incurred using personal credit cards or a personal loan to fund your business is not considered business debt. Net worth can be calculated if you are satisfied that all your assets and liabilities have been considered.

You might utilize one of the many available internet calculators to make things easier. When calculating net worth, make sure to include everything, and be as practical and as honest as possible with yourself.

Step 3 – Track Your Net Worth

Tracking your net value can be the time to take, but it is really necessary to understand where you are on your financial journey. You can use a spreadsheet like Microsoft Excel or Google Sheet to manually input your data.

Some people like this method as they can completely control the values and how the information is presented. For those who don’t want the manual effort, there are a number of apps, like Personal Capital and Mint, that can help you track your net worth and do all of the math for you.

- Because time is money, this saves you both time and effort. Make a system that works for you, and keep it up to date.

Step 4 – Having A Goal

Financial planning can be tracked on a baseline established by the creation of a balance sheet. Obviously, you want to grow your net worth over time so that when you retire, you will be worth more and have more money to sustain you.

At different points in your life, you should consider setting different net worth goals. Personal Capital estimates that the typical American’s net worth is $6,676 at 35 years old, $84,542 at 50 years old, and $194,226 at retirement age.

Though these numbers may look large, with the rising costs of health insurance and our cost of living, this is not enough. One of the ways we can increase our net worth is by generating passive income.

We must devise a strategy for putting our money to good use. Investing in real estate has historically returned an average of 6.4% per year over 36 years; therefore, owning real estate typically increases in value and can provide you with passive income.

Market investing has historically generated around 7 percent, depending on the account invested. With compound interest, even a low rate of return can develop into a large sum of money with enough time.

Brokerage accounts, CDs and individual retirement accounts (IRA) can also provide passive income. These accounts are insured by the Federal Deposit Insurance Corporation (FDIC) and may be less dangerous than at risk investments.

If you want more help to increase your net value, you can always consult a financial specialist.

Remember your net worth will be what carries you through retirement.

- You must take a hold and plan on how to increase it so that you can sustain the life you want during your retirement years.

Conclusion

Well-known business consultant and author, Peter Drucker, has a memorable quote: “If you can’t measure it, you cannot improve it.” In other words, it’s easier to improve items that can be measured.

Checking up on your net worth is a great way to spur growth. It lets you keep track of your spending and bills and make adjustments as necessary.

As a bonus, seeing your progress motivates you. As we’ve discussed, there are several options to track your net worth. Whatever approach you use, the most essential thing is that you stay informed and keep it updated to better understand your direction and how fast you’re going there.

That brings us to the end of our post. If you learned something new today, feel free to share it with your friends.