Introduction: Do You Understand Your Money?

Unlock your Financial Freedom Blueprint in 2025 with LoppZ. Master assets vs liabilities, build wealth, and create lasting income streams.

Do you feel that you don’t understand money at all? Do you ever question if you’re getting ahead and making progress toward your financial goals? Are you worried that you have no idea about your financial situation? If the answer to any of these questions was yes, don’t worry.

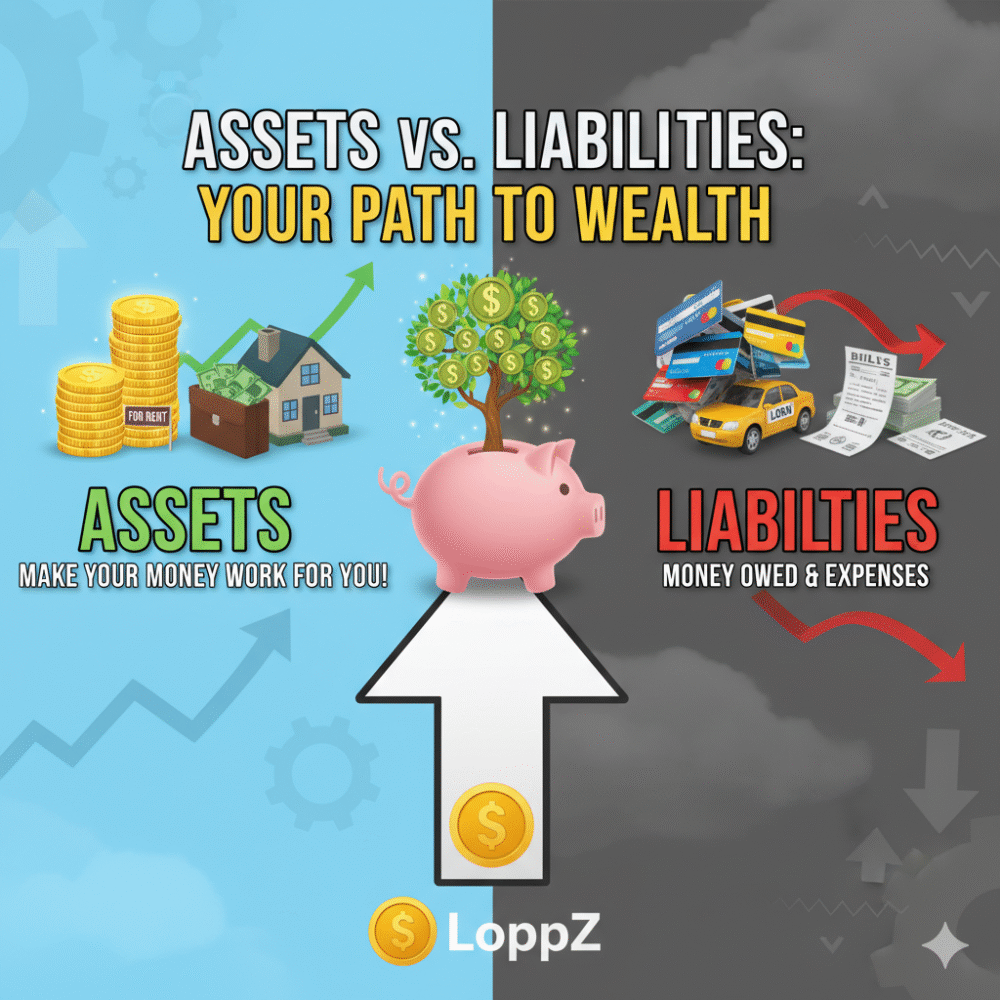

The answer to all these questions is to learn about assets and liabilities. In this post, we’ll be talking about assets and liabilities and how understanding the difference between these two concepts puts you on the path to the creation of wealth.

What Are Assets?

What are assets? If we go by the financial definition, “assets are a resource controlled by the enterprise as a result of past events and from which future economic benefits are expected to flow to the enterprise”.

Too confusing, right? In simple words, assets are everything a company, or person, owns. Assets are valuable because they can be transformed into ongoing revenue or a lump sum of cash if sold.

There is no limit to what you can define as an asset as long as it is, or can be, revenue producing. But to give a few examples, assets can be physical items, such as rental property, or intangible items, such as intellectual property.

A company’s assets are disclosed on its balance sheet, which is one of its essential financial statements. For an individual, this balance sheet would be our net worth information or even our budgets.

What Are Liabilities?

Now that we have talked about assets let’s talk about its opposite, liabilities. Liabilities include all a company owes now and, in the future, such as money due to vendors.

For us individuals, liabilities would be any and everything we pay debt on, including credit cards, student loans, vehicles, etc. So, they are all the things that we owe or we have borrowed.

Though this next part is more catered toward companies, understand that liabilities are typically broken down into two sub categories: current liabilities, those due within the next year or so, and long-term liabilities, due over a year from now.

To explain this better, let’s consider that you have a mortgage on your house. When you look at your mortgage statement, your current liabilities would be things like your property taxes, insurance, etc that are typically due either month-to-month in escrow, or yearly if paid in lump sum.

- The long-term liability for your house would actually be the total cost of your property being paid off, typically due in 30 years.

What’s The Difference Between Assets and Liabilities?

Now that we know what assets and liabilities are, we must know the difference between them. Assets are items that provide a financial value to a corporation or individual.

They aid the ability to make goods or deliver services both now and in the future. On the other hand, liabilities fulfill the obligations that have to be fulfilled, such as any money that is outstanding or a service that needs to be provided.

In accounting and from a professional point of view, in particular, assets are classified into six categories: current, fixed, tangible, abstract, operation and non-conducting. In reality, we want more assets than liabilities in order to have enough cash to pay our debts.

If you have more liabilities than assets, you will eventually be unable to pay your debts and face a financial crisis. Contrary to common belief, some liabilities can also be good for a business.

Real estate investment is often a showcase for this, as it’s typically considered “good debt”. The reasoning is because although you now have a liability in the form of paying a mortgage, if the property is being used as a rental, then someone else is paying the mortgage on your behalf (the renter), the property is typically increasing in overall value (appreciation), and if the purchase was done correctly, you may even have a little extra money after all bills are paid (cash flow).

- The end goal is to ensure that assets increase at a higher rate than liabilities.

How To Acquire More Assets

You must increase your assets over time or else you will be consumed by inflation. We’re aware though, that may be easier said than done, but let’s look at how we can accomplish this.

Saving and investing more money is the most straightforward strategy to increase assets. The more you save and invest, the more assets you will accumulate over time.

You will be earning interest with this strategy, and that interest will earn even more interest, the power of compounding. We believe the best way to start on this journey is to calculate out your expenses from your monthly income.

Then, simply set up a monthly transfer of some portion of the excess, to a savings account, set it, and forget it. Remember, you don’t have to make it any more complicated than it needs to be.

The great thing about this simple yet effective strategy is that you can even use it with investments. By automating, you can save money every month into an IRA or a brokerage account without having to think twice about it.

And before you realize it, your money will expand at a rate you never imagined. This could then allow you to invest in other asset building opportunities such as real estate or small business.

Types of Business Assets

In accounting and from a business perspective specifically, assets are classified into six categories: current, fixed, tangible, intangible, operating, and non-operating.

Your property may fall into more than one category; For example, a building is an example of a certain, tangible property. It is critical to ensure that a business’s assets are correctly classified.

Here’s a quick breakdown of these types:

Current Assets

Current assets are assets that can be converted into cash or cash counterparts within a year. Due to their importance to your company’s liquidity, they are also known as “liquid property”. Cash and cash equivalent, account receive, market securities and short -term investment are all examples of current assets.

Fixed Assets

Immovable properties within a financial year cannot be converted into cash or cash counterparts. He is also known as “long-term property” or “non-present property”.Patents, company Equipment, buildings, and machinery, are typical examples.

Tangible Assets

Tangible assets are assets that have physical existence. Real estate, cash, vehicles and machinery are tangible assets.

Abstract property

Abstract property is non-physical property that adds long-term value to business. Some intangible property may be trademarks, brand insignia and patent.

Operating Assets

Operating assets earn revenue through its core business operations and are typically required in the daily operation of the business. These can include the buildings, vehicles, and machinery belonging to the business.

Non-Operating Assets

Non-operating assets are assets that do not contribute to revenue generation through primary business operations but may contribute to income generation in other ways. Some examples of these could be vacant land, unallocated cash, and market securities.

How To Build Wealth: The Final Strategy

So how do we build wealth? You must increase your assets and reduce your liabilities along the way. The strategy to reduce your liabilities is simple, complete your obligations.

We are aware, though, that’s not as easy as it sounds. So, what are the steps to reduce your liabilities? The first step is to start being frugal with your money.

Examine where your money is going and eliminate wasteful spending. The next step is to free yourself from debt. Make it a priority to pay off your obligations (and not add on any others).

Lastly, set it and forget it. Automate your savings and investing to help you build toward your assets. Both liabilities and assets are essential components of doing business, both personally and professionally.

No firm, or person, can survive without developing assets. Increasing assets and limiting liabilities would allow the ability to generate cash flow. In the end, the secret to prosperity for individuals and companies is generating several income streams.

That’s our post for today; hopefully you now better understand assets and liabilities and how you can use both to grow your wealth. If you learned something new today, we hope you found this information valuable.