Introduction

LoppZ‘s Ultimate FIRE Guide 2025. Learn proven steps to achieve Financial Independence and Retire Early successfully. Begin

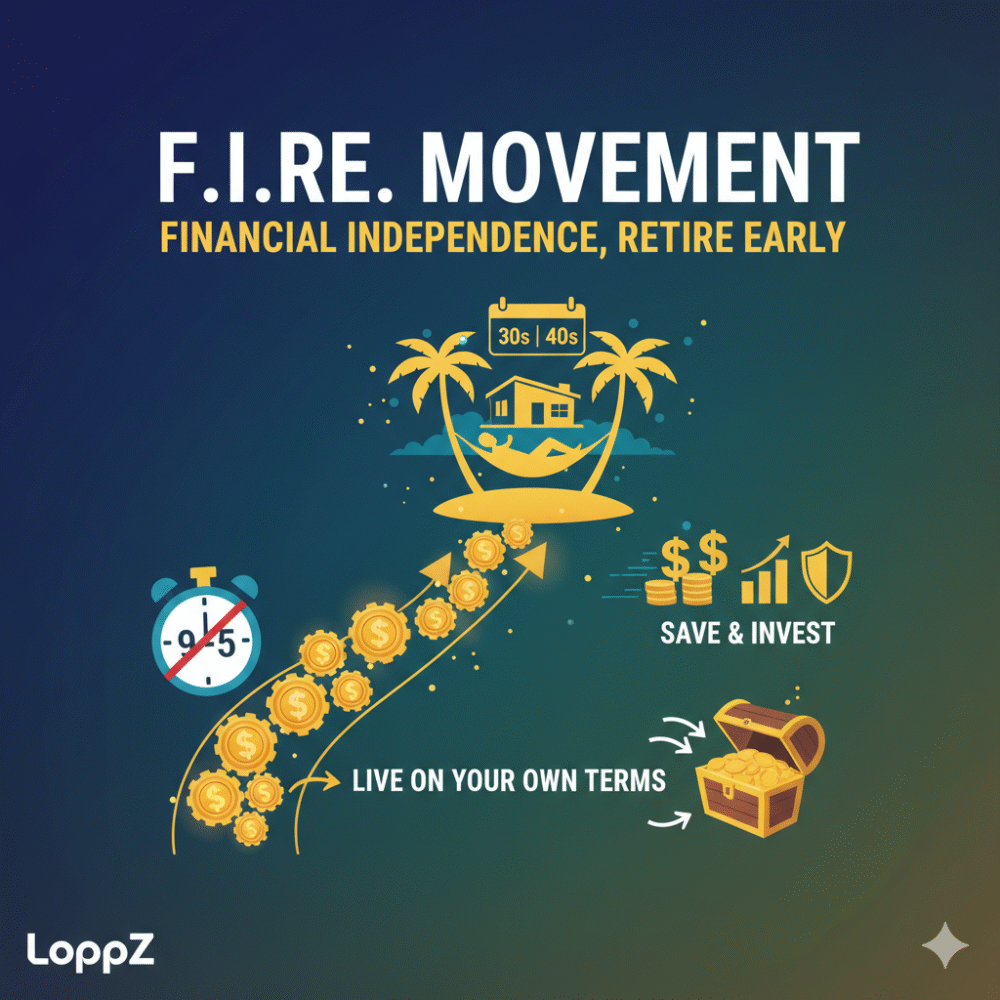

Have you ever stopped to consider that the typical directive in society is to first go to college, then get a good job, and lastly work for 40-50 years before you retire? Did you know you it’s possible to retire in your 30s or 40s? That there’s no actual law that states you must work until you turn 65 or 70? There’s a growing number of young people who dream about leaving the workforce and driving off into early retirement.

These individuals are part of a movement called F.I.R.E. In this post, we’re going to talk about what F.I.R.E. is, and if it’s something that interests you, how you actually go about diving into the process.

- Now, let’s get started.

What is F.I.R.E.?

What exactly is F.I.R.E? F.I.R.E simply stands for “Financial Independence, Retire Early”. The objective of this strategy is for you to save and invest as much as you can as early in your working years as possible.

Saving and investing 50-75%, of your net income, so you can afford to retire earlier, generally within your 30s and 40s. Now, if you’re already in your 30s or 40s, don’t despair, many have followed this technique to retire before they turned 65.

The main point, though, is that you need to save and invest a large portion of your total income. It is a movement defined by its frugality and it’s saving and investing.

- So, how do you do this?

How Do You Achieve F.I.R.E.?

To help you put away that much money for saving and investing, you need to be looking to do two things. You have to raise your income and, at the same time, keep your expenses extremely low.

With F.I.RE., the higher your income with corresponding lower expenses, the quicker you can reach your financial independence. The larger the gap between your income and expenses, the more amount of money you can put away to invest, and the quicker you can do that, the longer you allow your money to compound.

Many followers of the F.I.R.E. movement seek to save around 25 times their expected annual expenses. For example, if you anticipate your annual expenses to be $50,000.

Then you’d be looking to have 1.25 million invested. Then, utilizing the 4% rule (we’ll explain that a little later), you could safely withdrawn $50,000 every year without touching the principle amount invested.

- Now before we dive into how to get started down the path to retiring early through financial independence, we must first define what it means.

Traditionally speaking, financial Independence means reaching a point where your revenue generating assets produce enough income to pay all of your bills. It’s the point where you can handle your money problems without you having to work.

But for many others, it’s not only that. Financial Independence means freedom of your time. It’s the ability to determine just how you want to spend every hour of your day, whether that means traveling to a different city every month or hitting the golf course every morning.

The point is that financial independence is different for different people. Only you can define what financial independence means for you. Whatever your definition of Financial Independence, and no matter where you are on your financial journey, you need focus and intensity to achieve your dream of early retirement.

- Here are 5 habits you must begin to sharpen:

1. Change Your Money Mindset

To pursue something like F.I.R.E. requires commitment, intentionality, and absolute focus. It is not easy, if it were, many more people would be retiring early.

It’ll require a change in how you relate to money, what you consider a want vs a need, and a devotion to saving and investing that many may find obsessive, almost uncomfortable.

The journey to financial independence will test many of your limiting beliefs around money, so surround yourself with people, books, blogs, podcasts, and posts like this one shape and shift your belied in your abilities.

2. Set Goals

How can you possibly know where you’re going and if you’re on track if you don’t have defined goals? Before you start selling all your junk or cutting out those subscriptions, sit down and truly determine how much you spend every month and year.

Decide if this is a realistic number you want to live off of and figure out your “retirement number”. This your goal. When you hit this number, it’s the moment you’re financially independent.

Throughout your journey, this number may change; it may grow larger if you find a partner to walk life with or your dreams may change and allow you to scale it back.

- Either way, you must start with the end in mind.

3. Get Out Of Debt And Keep Expenses Low

The truth is, you don’t necessarily need to be totally debt free to be financially independent.

- Some may still carry a mortgage into early retirement as their passive income may cover that expense (and it’s been factored into the annual expenses).

The truth is, having no debt makes this much easier. But it’s not just getting rid of debt, you must also strive to keep your expenses as long as you possibly can.

If you can discipline yourself to slash unnecessary expenses out of your budget, you can have extra money to invest which will help you make serious progress toward your goal in the long run.

4. Prioritize Saving And Investing

If you want to retire early, you have to make saving and investing your utmost priority. There’s no way around it.

In fact your ability to save, your savings rate, is one of the biggest determining factors on if you’ll be successful in your pursuit of F.I.R.E.

The more you save, the more you can invest, and this goes for both retirement and non-retirement accoutns. This is why the F.I.R.E strategy radically encourages you to throw large sums of money into savings and investments to help you retire early.

5. Strive To Increase Your Income

One of your strongest tools to build wealth is your income. If you want to retire early, you have to be creative about finding means to make extra cash.

Whether that’s through your 9-5 job with additional certifications or you could decide to take on side hustles that you can turn into a small business.

Just find ways to make extra income. Whatever that may look like for you, having an additional income will boost your dream of stepping back from the workforce into early retirement.

- How To Calculate Your F.I.R.E Number Putting away money into savings and investments is great.

How To Calculate Your F.I.R.E Number

But you also need to know exactly how much you will need at retirement based on your current level of expenses. This is referred to as your F.I.R.E Number.

The amount varies person to person, but there’s a general rule to calculating it. It’s called the 4% rule. It’s based on the concept that a retiree can safely withdraw 4% (plus inflation) from their portfolio in any given year of retirement and not touch the principle amount.

This means you have to build your nest egg to equal about 25 times your annual spending needs.To do this, you have to know how much you spend annually in total including housing expenses, meals, healthcare, personal care, transportation, etc.

- For example, let’s say you calculated all expenses and you spent $75,000 annually. Based on this rule, you will need a $1,875,000 portfolio at retirement.

The formula is simple; annual expenditure X 25 = your F.I.R.E number On the other hand, let’s say you’re 30 and you want to retire at 45 with $1.25 million in your portfolio, then you have to put aside $83,000 per year into savings or investment.

To calculate this, subtract your planned retirement age from your current age. Then divide your desired portfolio amount by this value.

Conclusion

Now the pursuit of F.I.R.E. may not be for everyone, but there are clear benefits to the process. The main benefit of the FIRE approach is that it encourages you to think about retirement and plan your future.

It teaches you how much money you need to live the kind of lifestyle you want in retirement. Also, it helps you make plans to achieve your dreams.

Coupled with the financial ability and freedom to make decisions about your life, FIRE also teaches you to develop responsible and sustainable financial habits by setting up your savings focus and seeing through to your budget.

In its simplest form, the more you save and invest, the sooner you’ll attain financial independence and retire early.

That’s it for this post! Please do give us a thumbs up and subscribe to this channel if you hadn’t already. And don’t forget to share with a friend.